Managing personal finances efficiently is crucial for maintaining financial stability and achieving financial goals. One powerful tool that can significantly assist in this process is Google Sheets. As a cloud-based spreadsheet platform, Google Sheets offers numerous benefits for tracking expenses and managing finances effectively. In this article, we will explore the advantages of using Google Sheets for financial tracking and expense management.

- Accessibility: One of the primary benefits of using Google Sheets is its accessibility. With a Google account, you can access your spreadsheets from anywhere with an internet connection. Whether you’re at home, work, or on the go, you can log in to your Google account and access your financial data instantly. This accessibility ensures that you have real-time access to your budget and expense information, allowing for quick updates and informed financial decisions.

- Collaboration: Google Sheets provides seamless collaboration features, making it an excellent choice for couples, families, or roommates managing shared finances. Multiple users can work on the same spreadsheet simultaneously, eliminating the need for manual merging of data. This collaborative approach ensures that everyone involved in the budgeting process has access to the most up-to-date information and can contribute to expense tracking and financial planning.

- Customization: Google Sheets offers extensive customization options, allowing you to tailor your financial tracking sheet to your specific needs. You can create custom columns and categories to align with your unique income sources and expense types. By customizing the sheet to match your financial goals and spending patterns, you can gain better insights into your financial habits and make more informed decisions.

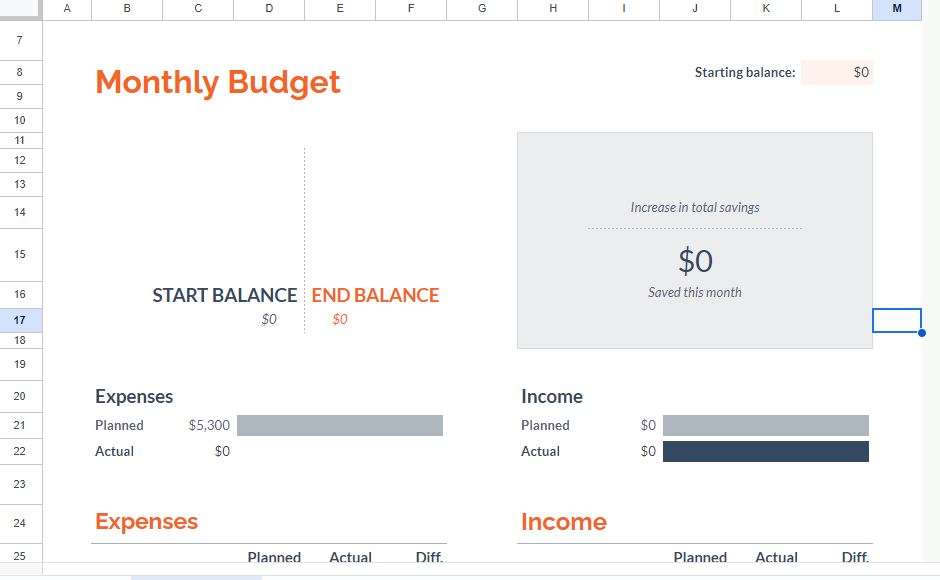

- Automation: One of the standout features of Google Sheets is its ability to automate calculations and processes. With built-in formulas and functions, you can create dynamic spreadsheets that automatically calculate totals, averages, and other financial metrics. This automation saves you time and reduces the risk of manual errors. For instance, you can set up formulas to calculate monthly expenses, track savings progress, or analyze spending patterns, making it easier to stay on top of your finances.

- Visualization and Analysis: Google Sheets provides a range of visualization tools, such as charts and graphs, to help you analyze your financial data effectively. Visual representations make it easier to spot trends, identify areas of overspending, and track progress toward your financial goals. Whether you prefer pie charts, bar graphs, or line graphs, Google Sheets has you covered, allowing you to gain a clear understanding of your financial situation at a glance.

- Integration with Other Tools: Google Sheets seamlessly integrates with other Google services like Google Forms and Google Calendar. You can use Google Forms to create surveys or questionnaires to gather financial data or feedback from others. Additionally, you can link your Google Calendar to your budget spreadsheet to keep track of upcoming bill payments, due dates, or financial milestones. These integrations streamline your financial management process and centralize your financial information in one place.

Conclusion: Using Google Sheets for financial tracking and expense management offers numerous benefits, including accessibility, collaboration, customization, automation, visualization, and integration with other tools. By harnessing the power of Google Sheets, you can create a dynamic and efficient system to manage your finances, track expenses, and make informed financial decisions. Whether you’re an individual looking to gain better control over your personal finances or a team working together on shared expenses, Google Sheets provides a versatile and user-friendly platform to help you achieve your financial goals.